With this guide, you can stay on track with your longer-term financial goals.īudgeting is a great way to keep track of your spending, income, and savings.

#Personal finance excel spreadsheets how to

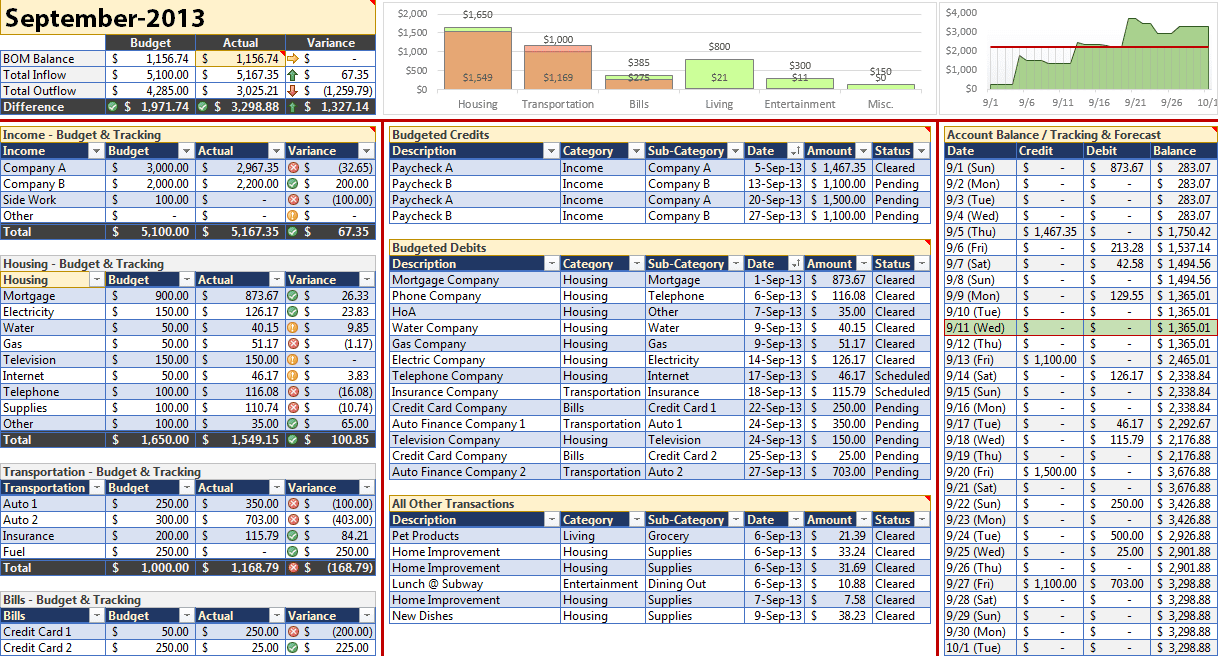

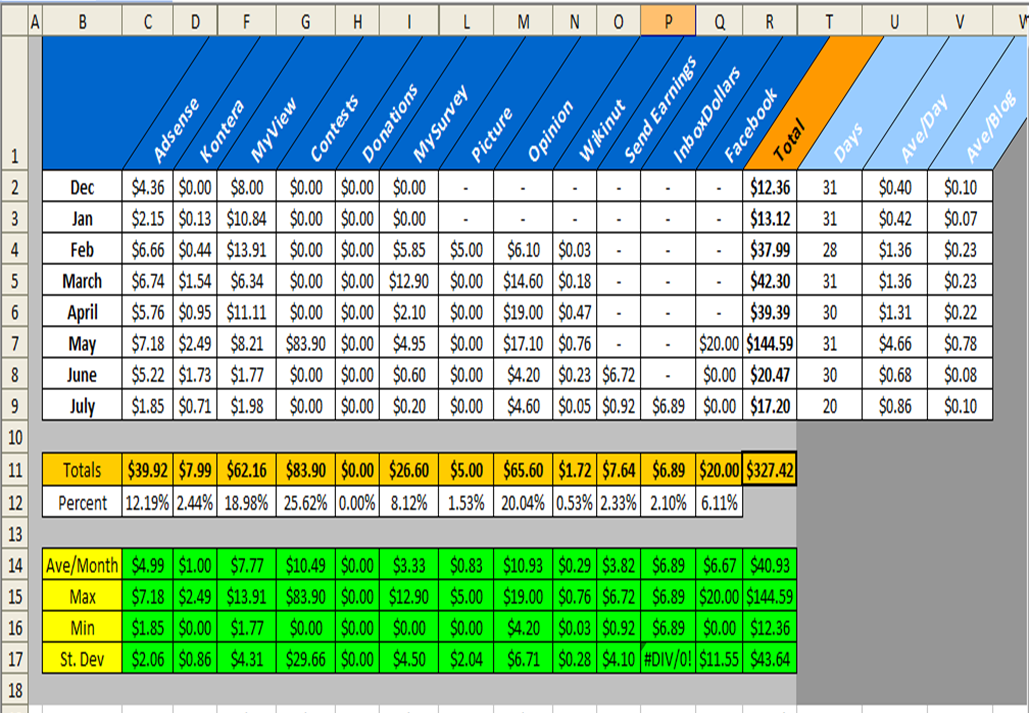

So, today, you’ll learn about how to use Excel to manage your finances to simplify your day-to-day money decisions. While most people use Excel to track their budgets, manually updating your budget spreadsheet every month is a time-consuming process.īut with the right knowledge of Excel, you can make the process a more seamless experience. But having the right tools can help make it less challenging. Managing personal finances is a daunting prospect for most people. You will learn how to use Microsoft Excel to manage and save money. So, if you’re intimidated by the idea of using Microsoft Excel to manage your finances, you’re in the right place. So, whip out your Excel sheet and start typing away.This blog post is your ultimate guide to how to manage your finances with Microsoft Excel. If you can see your finances spread out in front of you in an organized manner, you can manage and take advantage of them better. It will help you stay organized and focused and take control of various aspects of your life. Using simple tools like Excel, you can push the fast-forward button to achieve all your financial goals. While things can still be done manually, it is an inefficient way of doing stuff, and you will end up wasting a lot of time.

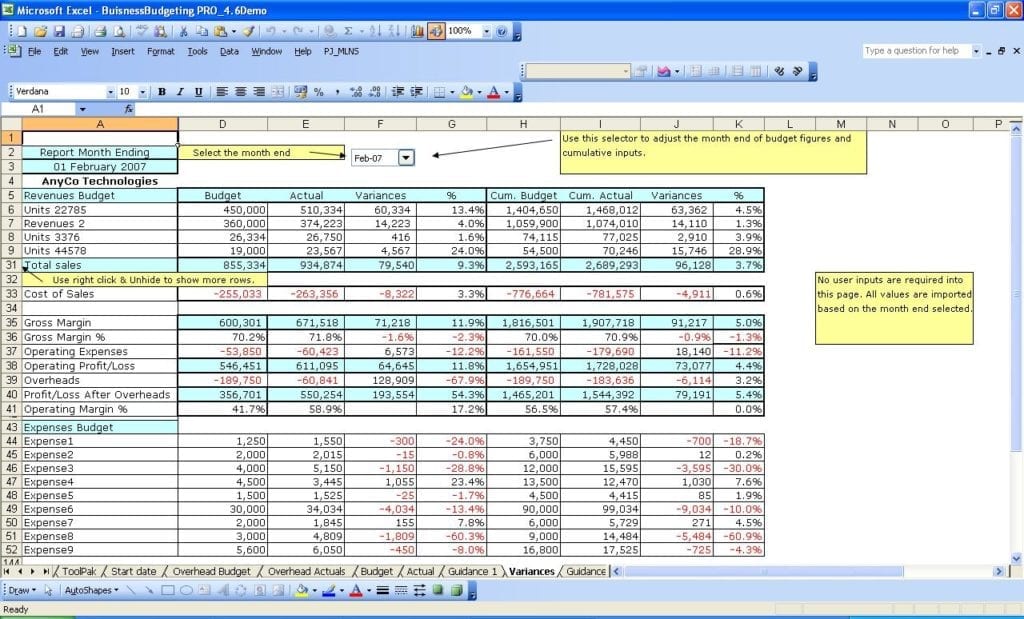

#Personal finance excel spreadsheets professional

You are losing out if you are not using tools to stay ahead of your personal and professional goals. You can make any changes, and the sum will keep adjusting.Įnd Note – Why Is Excel A Necessity For Achieving Financial Goals

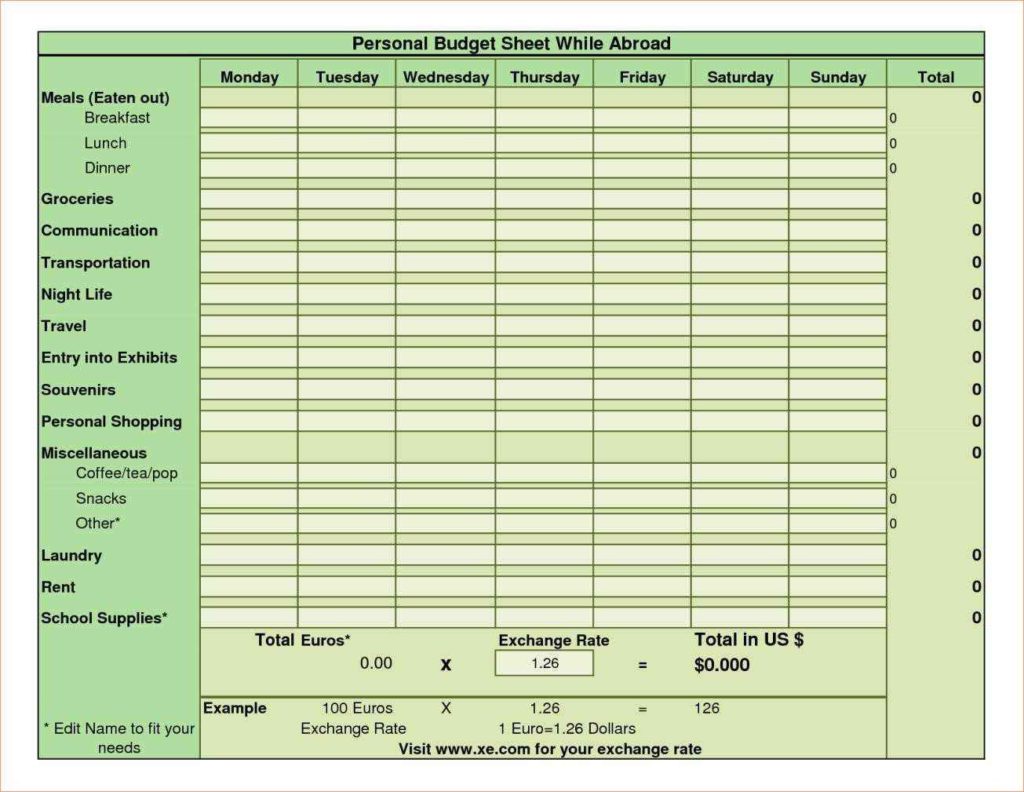

For example, if you add a function in the total column, the numbers you want to add will automatically be summed up and displayed in the total column. Formulas in Excel help automate a large chunk of the work you will do in the software.įormulas added in the top bar dictate how a cell in the spreadsheet should behave. You don’t have to sit and manually enter each number and then add them to calculate the result. There are ways you can make several activities in Excel automated. Use Functions And Formulas For Better Management This will save time and help you get a quick overview of your money situation through just one peek. You can make pie charts, bar graphs, and other pictorial depictions of your finances. Moreover, you don’t have to keep the spreadsheets dry and boring as you manage your money.

Excel will help you figure out where you are spending excess money so you can redirect it to paying for debt or achieving other financial goals. If expenditure is not coherent with your financial goals, it's time to make changes.įor example, if one of your financial goals includes clearing all debt by a certain date, but you have little to no money in your savings fund for debt, you are off track. Analyze this data to know in which category you spend the most.

You can record your expenses, investments, emergency spending, savings, and more here. A budget spreadsheet template can help you stay in touch with your money flow. And the first step to achieving your financial goals is knowing where the money is going and how you can control it. If you want to create an easy system to help you keep track of your money and build a strong financial system, keep reading to learn how to use Excel.īudgeting is an essential part of keeping track of finances. Excel is not a complicated tool for high-tech people alone, but it is a great tool, and it can help you easily navigate the world of your finances and achieve money goals. However, did you know that you can also use Excel for your financial goals? Visit any company, large or small, and you will see several spreadsheets used to deal with money. Excel has become a staple tool in contemporary business environments.

0 kommentar(er)

0 kommentar(er)